I’m imagining that at some point the European Commision gets wind of this project and I’m deciding to mimic amateurishly how they would go about it. I’m coining the cryptocoin the ‘European Basic Guilder’.

European, as membership is for Eurozone Citizens only.

Basic, because it will provide Basic Income in the form of redistributed tax.

and Guilder because it sounds like Gold, thus worth a lot. (It’s not because I’m Dutch. Trust me, I swear. I would never want to sway the European Commission to name it after my country’s old currency in the case they would want to create a monetary union cryptocoin. And in case you are a Euro Commissioner reading this, thank you for taking your valuable time Sir. ![]() )

)

The benefits of this coin for the European states and Union is that a single cryptocoin can be assigned to, to have it’s taxes be collected in. The benefits of it’s citizens is that they can pay their taxes in cryptocoin.

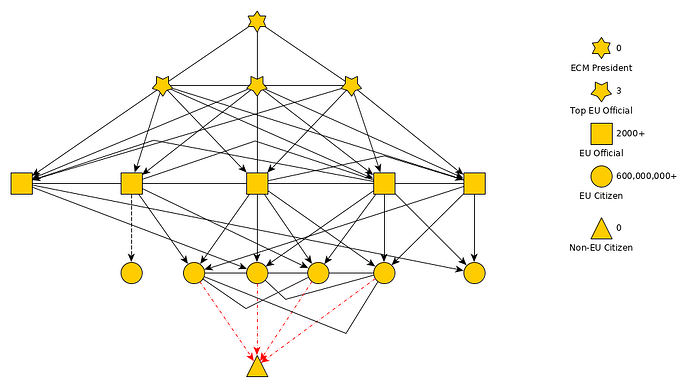

We will have 5 layers:

- President of the European CryptoMint (ECM)

- Top EU officials

- EU officials

- EU citizens

- non-EU citizens

This is going to be the setup ultimately. I’m not sure if this is feasible for this test right now, because what’s more important at the moment is finding people willing to test this.

Recommended setup for Duniter is:

If I correctly remember how Duniter works, I can just assign a low maxstep and this setup would work.

? Currency name European Basic Guilder Test

? Start computation of a new block if none received since (seconds) 1200

? Universal Dividend %growth 0.000054218

? Universal Dividend period (in seconds) 86400

? First Universal Dividend (UD[0]) amount 100

? Delay between 2 certifications of a same issuer 0

? Maximum stock of valid certifications per member 300000

? Maximum age of a non-written certification 604800

? Certification validity duration 31536000

? Number of valid certifications required to be a member 3

? Maximum age of a non-written identity 604800

? Maximum age of a non-written membership 604800

? Percentage of sentries to be reached to match WoT distance rule 1

? Membership validity duration 31536000

? Number of blocks on which is computed median time 20

? The average time for writing 1 block (wished time) 960

? Frequency, in number of blocks, to wait for changing common difficulty 10

? Weight in percent for previous issuers 0.6666666666666666

Scope

Goal

- A daily basic income for Eurozone citizens with eID only.

- A cryptocurrency as a service to pay taxes with for EU citizens.

- A standard cryptocurrency for European tax collection agencies.

Constraint

- The cryptocurrency shall not constraint citizens to use other cryptocurrencies.

Currency

Membership via eID .

- DigiD (Netherlands)

- eHerkenning (Belgium)

- 2% inflation a year when there is 0% population growth.

- The president hands out a certificates to officials

- The officials hand out certificates to themselves

- 100.000(x3) European citizens per official.

- EU citizens can not add newcomers to the Web of Trust.

Since this is a simple currency test, we don’t need to check anyone upon identity for now.

Logo

![]()

Le guilder. Ce n’est pas un golder. Ce n’est pas un guild’or.