I now did some investigation in Duniter and I am wondering something. Is there any step plan on how to roll out a non-testnet version of Duniter money ?

The reason I ask is the TMR theory seems to based on ‘pseudo-isolated economic zone’ and on reference value to give the money real live value in representing wealth, e.g. that amount money M also represents a stable amount of real life wealth.

I do see these things as possible road blocks on getting a Duniter based money fulfilling the free money where money is representing real wealth.

Next steps for Duniter are the following :

-

At the beginning of 2017, start a new test currency called GTest.

The parameters of this money will probably be :

c = 3,5714% / day (dividend formula DU(t+1) = DU(t) + c² M/N)

Certifications stock : 150

Number of necessary certifications to enter : 3

Maximum distance between members : 5

1 certification / day maximum

Certification duration : 150 jours

Membership duration : 3 mois -

Some months later, start the first real Duniter currency, with a growth of c = 0.026% / day.

Absolutely not. This is inconsistent statement. Please study carefully the RTM first before speaking about it. Now you are spreading false information about it, that is not fair at all.

Since this is one of the worst translated part of the RTM, I advice you to take a read at this part using Google translate. I find it a lot clearer than that we translated too fast :

Money thus plays the role not only as a tool of exchange between individuals in the economic zone, but also as a value independent of the observation frame of reference.

Hi all how is it going.

I have some questions.

c is a constant or? So why the formula has c² and not simple c?

(dividend formula DU(t+1) = DU(t) + c² M/N)

What yearly inflation would have the currency with:

c = 0.026% / day.

Is there are a clear path (even if not yet coded) to change parameters like certification duration etc after the currency is started?

Hello Arcurus, everything is going fine so far, @cgeek is finishing a really nice version which will clean and simplify a lot the core code ![]()

Here are the explanations (in french) : Formule alternative pour le DU - #61 by Galuel, which is translated nicely by google :

To understand simply the proof of DUĞ = DU (t + 1) = DU (t) + c² (M / N) (t)

By definition, DU is the variation of M / N with: (M / N) (t + 1) = (M / N)

It is enough to multiply by c the terms of this equality, we obtain: (E): c * (M / N) (t + 1) = c * (M / N) )

The equality is also evident:

C (M / N) (t + 1) = DU (t + 1) (1)

C (M / N) (t) = DU (t) (2)

DU (t) = c * (M / N) (t) (3)

(E): DU (t + 1) = DU (t) + c² (M / N) (t) is replaced by (1), (2) and (3)

The advantage of this formulation is that it takes into account the variations of “N” while ensuring a high stability to the evolution of the DU (t), even in the case of a great shake, since if N decreases by a factor 1 / c (Factor 10 for c = 10%), the DU (t + 1) will only vary by a factor of 2, and if N increases by a factor 1 / c the DU (t + 1) will always remain slightly above DU (t).

This formulation is called “second order approximation”, whereas DUA, DUB and DUC are “first order approximations”.

The higher the order of an approximation, the more complicated the formulation, but the more correct it will be. However, it is also shown that if the calculation step is very fine, (the unit of time is “small”, or the “c” of calculation is “small”) plus a given approximation will be just as well.

We note that the graph of DUĞ smooths the variations with flexibility, whereas the approximations of the first order either do not take into account the variations of “N” or show “acute angles” when returning to normal.

Basically, it’s the same equation but at an higher order. It’s more precise and support better the evolution of members count in the community.

10% ! ![]()

(1+10%)^(1/365) = 1.00026 → 0.026% a day

At the moment this is not something we imagine. We will try to have fixed parameters at first, but if it causes problems to the WoT, we will have to find a way to make parameters evolve. We will think about it if necessary when it happens I guess ![]()

You’ll need to help me in understanding where I am going wrong then as I did read the TMR.

First it is then not clear to me what the purpose of the ‘Pseudo-isolated economic zone’ section in the definitions chapter is.

A non-test version of the Duniter currency will be launched but it is not clear to me what the plan is to determine the value, e.g. purchase power of the released money. Is it planned to be usable as real money, e.g. to buy things with it ? Are there any plans to steer the value, e.g. the purchase power of your released currency ? Will it be launched on exchanges ? Will there be people who plan to use this currency as their daily money ?

To me it does not make much sense to release a currency where the money supply fulfills the TMR rules but still has a big fluctuation in purchase power and thus has possible high inflation/deflation in purchase power due to fluctuating exchange rates with other currencies.

The problem is that you create something that did not exist before. From 0, to N units. The mathematical derivative here is infinite : it will have a purchase power which will fluctuate, we cannot avoid it.

The difference with bitcoin is that since everyone is a co-producer of the currency, it should be a lot smoother : the more users of the money there are, the more stable it gets, and the more things we can buy with it (and so, the more valuable it is)

Our time is limited, our goal is to start the money with basic software available to exchange (wallets). But for the other features… it’s up to the future developers using the money ![]()

In France, there are already people who plan to use this currency daily (see http://www.le-sou.org/ and http://www.monnaielibreoccitane.org/).

Think about two values V1 and V2, with V1/V2 “fluctuating”. Is it V1 that fluctuates, or V2 ? To undestand what is RTM really you should study it, and make the Galilee Module (use Google Translate to read it too).

If you are not able to study the first, or make the second, you can also listen to Tathoo who posted an english version of comments about Galilee module.

I think you could already help a lot if you could explain the purpose of the ‘Pseudo-isolated economic zone’ section in the defintions chapter of the TMR. If you just keep on referring to things I already read I won’t be able to improve my understanding.

In France, there are already people who plan to use this currency daily (see http://www.le-sou.org/ and http://www.monnaielibreoccitane.org/).

So do I understand correct to say that main (first) use case of Duniter to have several smaller/local communities have their own free money currency ?

I am more looking from the point of view of a world wide tool for basic income distribution.

Galuel has been explaining the RTM everywhere for 5 years, so he prefers to refers to previous explanations.

The goal of the pseudo-isolated economic zone is to reduce the problem analyzed here (the money) to its simplest form. So that you can see and deduce things.

Not at all ![]() Because a Duniter money has the same density everywhere, these communities will be able use the same Duniter currency without any problem of localization. They will use the world wide ubi tool locally. They are promoting it so that they can exchange with it as soon as possible.

Because a Duniter money has the same density everywhere, these communities will be able use the same Duniter currency without any problem of localization. They will use the world wide ubi tool locally. They are promoting it so that they can exchange with it as soon as possible.

OK, but then you mean that there is one world wide value for Duniter and you will organize universal dividend also globally. I do expect problems if there is not some kind of coordination planned and you rely on laisser-faire. There will surely be some capitalists that will try to abuse the system.

At the difference from bitcoin and other cryptocurrencies, Duniter is not a rare currency and no one will be able to buy all existing and future units of a Duniter currency for $ or € issued arbitrary.

It’s dense, issued regularly, and at the same rhythm for any human. So we don’t think that this currency can be abused easily - its robustness is in the code of the currency (I’m not talking here about the software but about the code of the money). After all, who would want to exchange a currency for another currency that he is not the issuer in any way ?

Another example, by comparing a libre money to a UBI issued using a debt-money system. To finance an UBI in € you need to you need to be certain to tax it where it is. You have to stop money from being hidden in fiscal paradises, etc… In fact, this is the reason why I don’t think a financed UBI can be qualified as unconditional : money can be hidden, credits can disappear. Money can disappear, and then the UBI disappears with it. Because they are able to manipulate the money supply, it is probably already abused by the states and the banking system.

With a UD, all of this cannot happen : it remains coproduced, at the same rhythm, wherever you are, whatever is your age and the time you joined the economy.

im not really sure if i got the advancement of using c²,

isnt it that using c² will end up with a smaller inflation per year?

Just take 10% per year. 10% * 10% = 1% so with c=10% the DU inflation would be 1% per year instead of 10% or?

M/N is not the DU = c*M/N

(a) DU(t+1) = (1+c) DU(t) and (b) DU(t) = c*M/N(t)

Just replace the DU(t) in (a) by (b) and you will have it. By the way, try to make the Module Galilée to understand this.

The c² is for the derivative of the Universal Dividend. Look at the formula, Du(t+1) = DU(t) + its derivative. As you can see, the previous UD is taken into account :

DU(t+1) = DU(t) + c²(M/N)

DU(t+1) = c(M(t)/N(t)) + c²(M(t+1)/N(t+1))

The advantage of this formula is that big variations of N do not breaks the computed Universal Dividend. For example if N is divided by 10, the UD computed using the first order formula will be divided by 2, whereas with the second order formula, it will be a bit lower but not that much.

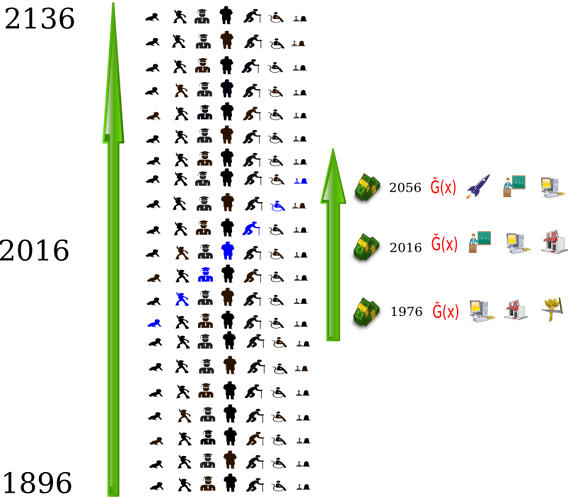

See how the variation of N is absorbed smoother in the second order formula :

https://forum.duniter.org/uploads/default/original/2X/7/715703410d88438f6143e24590d9d23214aa5542.png

But exchanging money is a major way of determining it’s value. So with Duniter you trust that after the release of the stable Duniter there will evolve a world wide way of determining the value of Duniter and also to have it coordinated between the different communities using it and not have exchange in other currencies as a way of doing that ? To me it seems kind of difficult at least.

To me this is different to what we are discussing here, you give the basic income in EUR or Bitcoin and at that moment this has a certain value. What people do afterwards is their choice.

The problem with Duniter I always stumble on again is that the amount of the UD is determined by the code but the value is uncertain, to be usable as basic income it should be enough to live from it but I don’t see anything guaranteeing that. You guys think you can solve that after you release the stable coin. I have a hard time to decide if that is OK or not, so I’m not saying it’s not possible but also not if it is OK.

I do think we understand each other now on the value aspect of Duniter and likely time has come to agree to disagree.

Another ‘interesting’ aspect of Duniter is that the amount of Duniter one owns is public, each person has one public key with it’s verified identity and everybody can see the amount of Duniter related to that public key. I have to admit I am not (yet) a hard-core free money believer so I certainly want to ‘hide’ part of my wealth in a non-Duniter coin.

Another aspect still open for me is that I don’t see how you can avoid debt with Duniter: “Can you do this for me ? I’ll give my next 5 UDs to you.”. So is in the end the target to not use money anymore as investment/capital to generate wealth and have part of the generated wealth then distributed again as interest on the capital ?

Like a lot of the people I also do think the capitalist and the money system has gone too far and too much benefiting the people who already have a lot but I also think that trying to get rid of all capital investment will seriously hamper wealth generation.

To become a usable basic income, it needs for sure to be used by a lot of people. If enough people use it as a currency, then it will be valuable. But it can not be valuable before individuals gives it some value. And nobody can guarantee you that anything will be valuable in the future, because value is given by individuals. Because individuals are getting born and die, they change and evolve with time, and values change with them.

For Duniter, because the currency is created by individuals, even if individuals change, the currency will still be there, created at the same rate as any individuals did before them. This issuance is symmetric in space and time, and so it becomes invariant to the individuals using it, even if they are not the same in time.

In Duniter, your public key associated to your identifier is here to generate the Universal Dividend. Once you generated it, you can transfer money to a public key which is not associated to any public id. In this way it remains the same as in bitcoin.

Yes, when we speak about debt money, banks do not have the money they lend. They create it out of thin air. In Duniter, debt can still exist, but debt is not money. Debt is measured in money units, and that makes a big difference. You can only lend money you have, and you cannot credit accounts and ask to be reimbursed just because you are a bank.